Social Security Withholding Guidance

Relief with Respect to Employment Tax Deadlines Applicable to Employers

Relief with Respect to Employment Tax Deadlines Applicable to Employers

As state leaders attempt to develop guidelines for reopening safely,

Uncertainty and unrest have defined 2020. From COVID-19 and record-breaking

On June 5, 2020, President Trump signed the Paycheck Protection

The landmark COVID-19 stimulus package, the Coronavirus Aid, Relief, and

Businesses across the globe have experienced unprecedented interruptions and closures

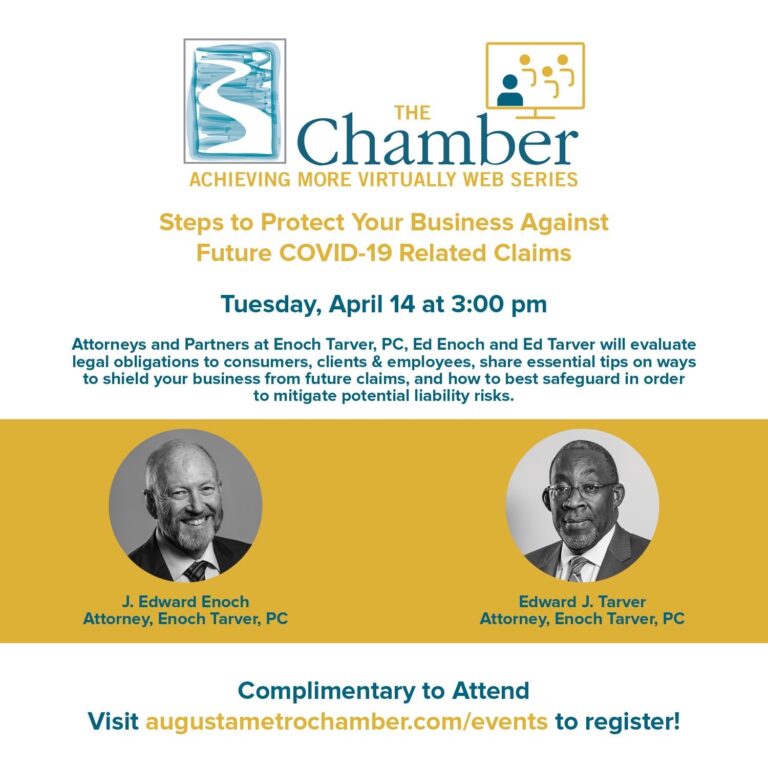

Join the Augusta Metro Chamber and local law firm Enoch

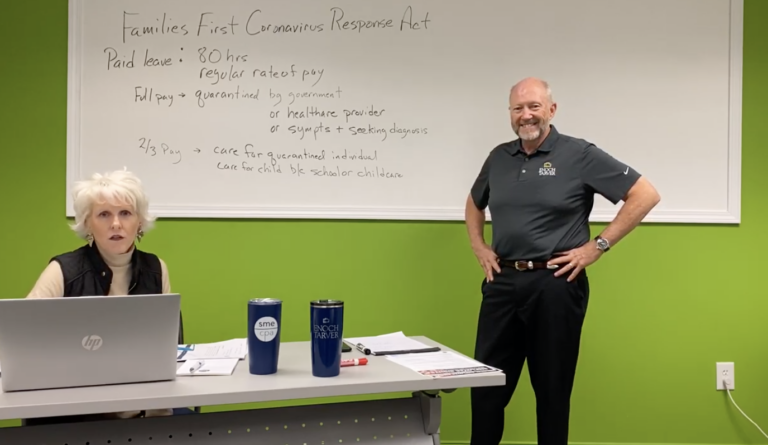

Professional small business attorney, Ed Enoch, and CPA, Lisa Mayo,

Andrea Usry, SME CPAs and Ed Enoch, Enoch Tarver Law