Key Considerations for Noncompete Agreements

Companies grow by investing time and money in various resources, including their employees. Yet business owners are often anxious about losing their investment, i.e., the time they spend training new hires and the confidential information they share with their new employees. Once confidential information is shared, there is a risk that an employee will leak […]

Understanding Payroll as an Employer

Congratulations! Your business has grown and you are ready to hire your first employee. Where do you begin? What will the employee’s schedule be and how much will the employee get paid? Will your new hire be an employee or an independent contractor—and what is the difference? Did the employee sign an employment agreement? Before […]

What You Need to Know About Buy-Sell Agreements

If you are a business owner, you probably worry about your bottom line, employee retention, and health insurance premiums, but have you also considered what will happen to your business if you are in an accident? What if your business partner gets divorced and your partner’s ex-spouse is awarded part ownership of the business and […]

Social Security Withholding Guidance

Relief with Respect to Employment Tax Deadlines Applicable to Employers Affected by the Ongoing Coronavirus (COVID-19) Disease 2019 Pandemic Notice 2020-65 On August 8, 2020, the President of the United States issued a Presidential Memorandum directing the Secretary of the Treasury (Secretary) to use his authority pursuant to section 7508A of the Internal Revenue Code (Code) to defer […]

Navigating Periods of Uncertainty and Unrest as a Business Owner

Uncertainty and unrest have defined 2020. From COVID-19 and record-breaking unemployment to ideological, political, and societal conflicts, business owners have faced significant challenges to their survival and success. Regardless of their current political views or health and financial statuses, business leaders agree that they must navigate this time with care. The decisions that business owners […]

More Good News for PPP Borrowers: Simplified Loan Forgiveness Applications

On June 5, 2020, President Trump signed the Paycheck Protection Program Flexibility Act (the Flexibility Act) into law, after lawmakers passed it almost unanimously. The original Payment Protection Program (PPP)—a key component of the Coronavirus Aid, Relief, and Economic Security Act signed in March—and the accompanying guidance issued by the Small Business Administration (SBA) and […]

Good News for PPP Borrowers: The New Paycheck Protection Program Flexibility Act of 2020

The landmark COVID-19 stimulus package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, has been a significant tool for assisting struggling small businesses during the current international pandemic. However, the centerpiece of this legislation, the Paycheck Protection Plan (PPP), has been a source of confusion and frustration for many business owners seeking this aid. […]

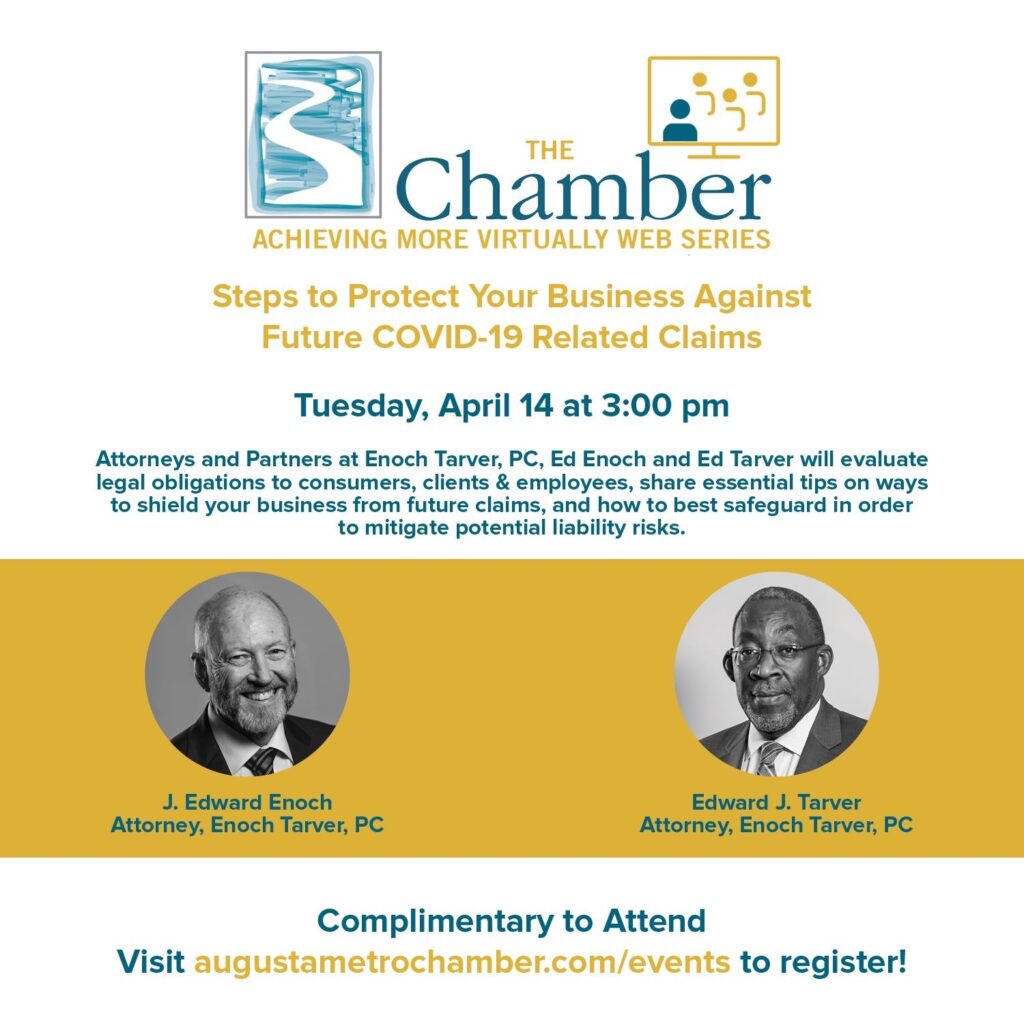

Steps to Protect Your Business Against Future COVID-19 Related Claims

Join the Augusta Metro Chamber and local law firm Enoch Tarver, PC to determine how to protect your business against any future COVID-19 claims that may arise now or during the future of recovery. Attorneys and Partners at Enoch Tarver, PC, Ed Enoch and Ed Tarver will evaluate legal obligations to consumers, clients & employees, share essential […]

FAQ and Discussion Questions Regarding EIDL and PPP for Small Business

Professional small business attorney, Ed Enoch, and CPA, Lisa Mayo, provide insight to commonly asked questions regarding EIDL and PPP Loan programs for small business owners. Joined by UGA SBDC Augusta Area Director, Rick McMurtrey and Moderator Rebecca Kruckow, the panel works to help owners understand options for assistance and ways to work through our […]

Ed Enoch and Andrea Usry Discuss the Families First Coronavirus Response Act

Andrea Usry, SME CPAs and Ed Enoch, Enoch Tarver Law Firm explain the Families First Coronavirus Response Act and the new guidelines for unemployment. Contact Ed at jenoch@enochtarver.com or call 706-738-4141 for more information or to discuss your specific situation. Click the link to watch the video recording on YouTube: Families First Coronavirus Response Act […]