Why You Should Consider Putting Your LLC into a Trust

The limited liability company (LLC) is a popular business structure that offers liability protection and avoidance of double taxation. Trusts are popular asset transfer vehicles that allow you to avoid probate and keep assets out of the hands of creditors. By placing LLC membership interests in a trust, business owners can combine the two types […]

Elections in the Time of COVID

[metaslider id=1086] Download the presentation here: Elections in the Time of COVID Absentee Voting Request for absentee ballot for November election is currently available: Click Here SoS has reopened grant applications for counties to request funding for absentee ballot drop boxes: Click Here SHRM Resources SHRM A-Team Elections Resources Together Forward @Work

Navigating Periods of Uncertainty and Unrest as a Business Owner

Uncertainty and unrest have defined 2020. From COVID-19 and record-breaking unemployment to ideological, political, and societal conflicts, business owners have faced significant challenges to their survival and success. Regardless of their current political views or health and financial statuses, business leaders agree that they must navigate this time with care. The decisions that business owners […]

Force Majeure Clauses in Light of COVID-19

Businesses across the globe have experienced unprecedented interruptions and closures because of the COVID-19 pandemic. As a result, many businesses are finding it difficult to perform their contractual obligations. Consequently, a common but often overlooked contractual clause is in the limelight: the force majeure clause. Contrary to popular belief, the mere existence of a force […]

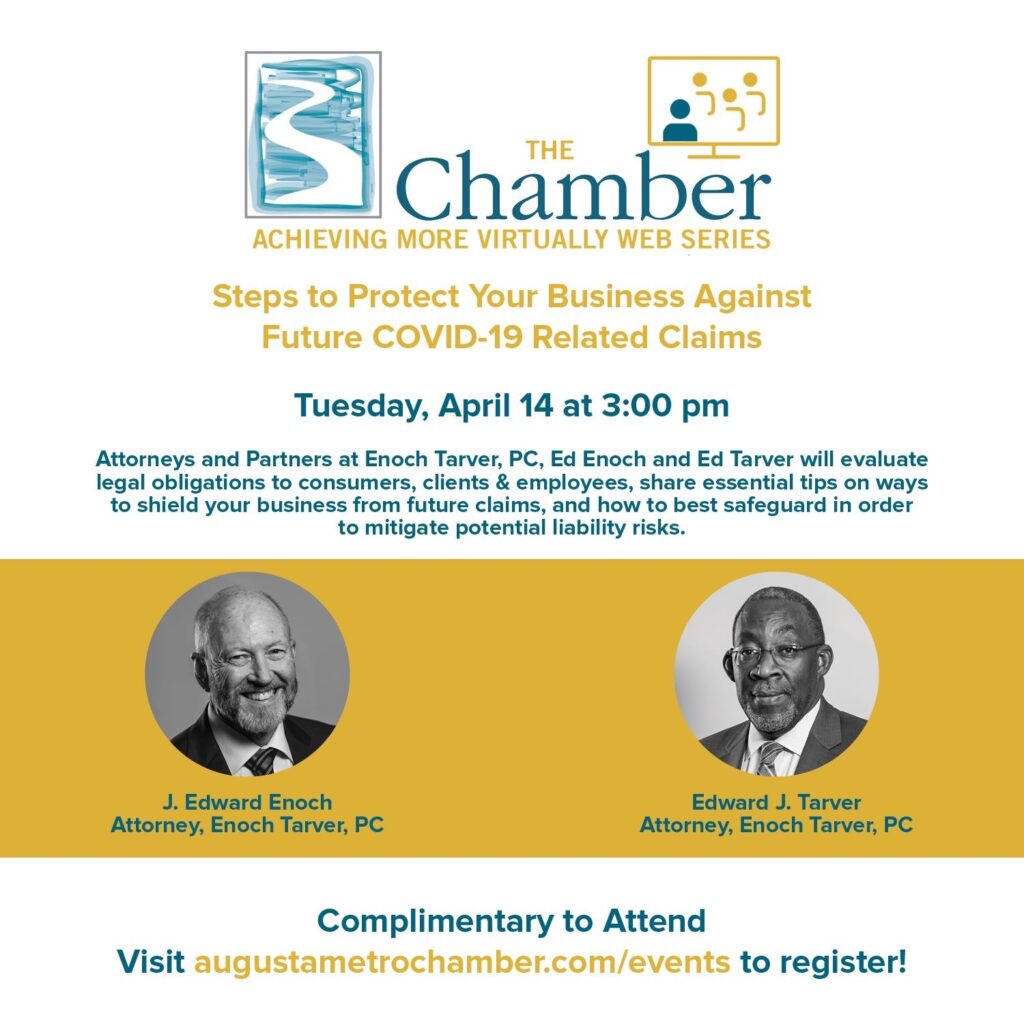

Steps to Protect Your Business Against Future COVID-19 Related Claims

Join the Augusta Metro Chamber and local law firm Enoch Tarver, PC to determine how to protect your business against any future COVID-19 claims that may arise now or during the future of recovery. Attorneys and Partners at Enoch Tarver, PC, Ed Enoch and Ed Tarver will evaluate legal obligations to consumers, clients & employees, share essential […]

Impact of Tax Reform on Small Businesses

Now that it’s tax season, you may be concerned about how the Tax Cuts and Jobs Act, enacted in December 2017, will impact your small business. The reforms represent the most sweeping tax overhaul in 30 years and could have a positive impact on your business’s bottom line—but they may have left you feeling a […]

“Lead From Where You Are” SHRM Presentation

Our very own Ed Enoch had the pleasure of presenting at the Society for Human Resource Management last week. Watch the full presentation here!

What is the Difference Between an LLC and an LLP?

If you are starting a new business, the type of business entity you decide to establish will have an impact on the extent of personal liability, how the business is taxed, its management, the level of formality required, and many other factors. There are a wide variety of options, which can make this decision quite […]

What Counts as “Hours Worked” Under the Fair Labor Standards Act?

If your small business has non-exempt employees covered by the Fair Labor Standards Act (FLSA), you are required to pay those employees in accordance with its minimum wage and overtime requirements for all “hours worked.” This may seem like a simple requirement, but figuring out what is considered “hours worked” may be more complicated than […]

Does Your Small Business Need a Social Media Policy?

According to 2018 data provided by SCORE, the largest provider of volunteer business mentors in the United States, 77% of U.S. small businesses use social media for their sales, marketing, and customer service. If you plan to use social media to promote your business, a social media policy is essential to protect your business’s reputation […]