Elections in the Time of COVID

[metaslider id=1086] Download the presentation here: Elections in the Time of COVID Absentee Voting Request for absentee ballot for November election is currently available: Click Here SoS has reopened grant applications for counties to request funding for absentee ballot drop boxes: Click Here SHRM Resources SHRM A-Team Elections Resources Together Forward @Work

Record Keeping Requirements for Business Owners During COVID-19

As state leaders attempt to develop guidelines for reopening safely, you may have questions about the requirements for maintaining a safe environment for your business. Specifically, you may be wondering how to document the steps you have taken if someone in your workforce is exposed to COVID-19 and tests positive for the virus. The Occupational […]

More Good News for PPP Borrowers: Simplified Loan Forgiveness Applications

On June 5, 2020, President Trump signed the Paycheck Protection Program Flexibility Act (the Flexibility Act) into law, after lawmakers passed it almost unanimously. The original Payment Protection Program (PPP)—a key component of the Coronavirus Aid, Relief, and Economic Security Act signed in March—and the accompanying guidance issued by the Small Business Administration (SBA) and […]

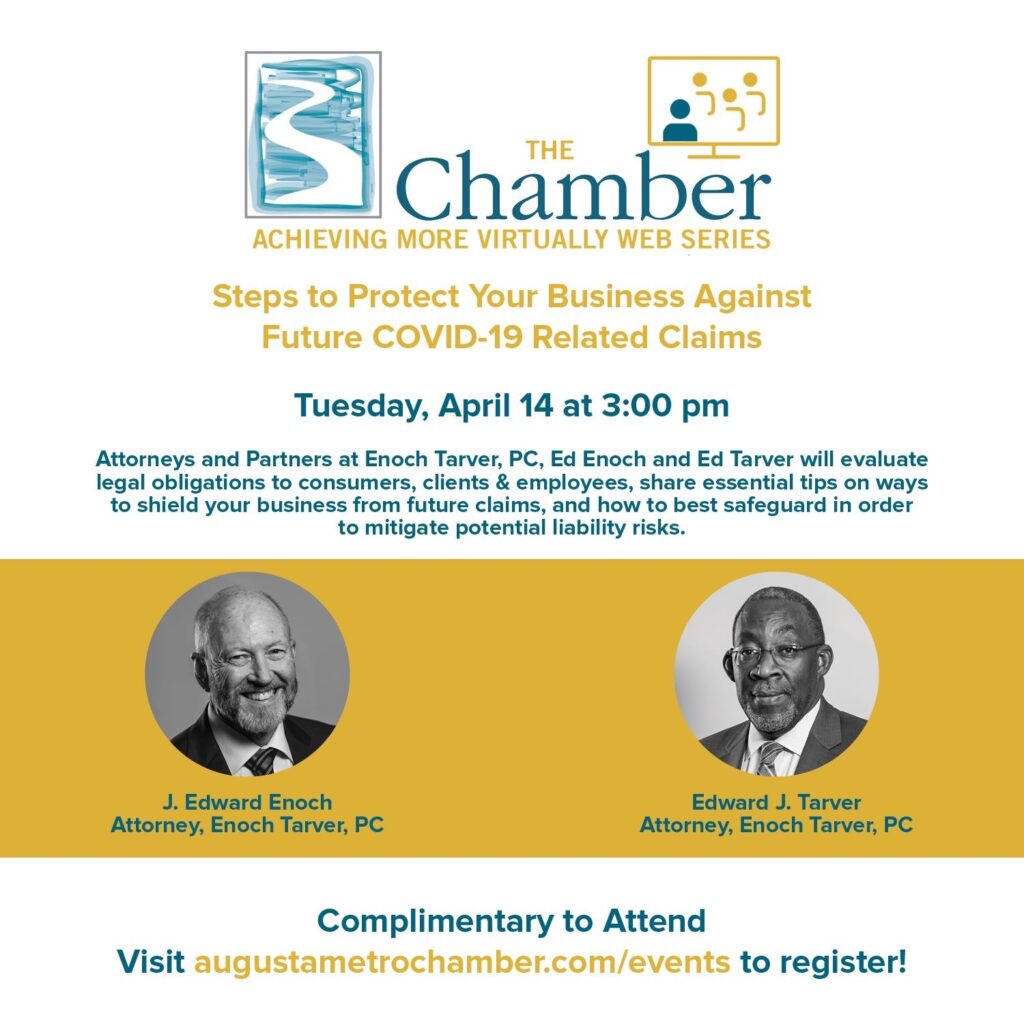

Steps to Protect Your Business Against Future COVID-19 Related Claims

Join the Augusta Metro Chamber and local law firm Enoch Tarver, PC to determine how to protect your business against any future COVID-19 claims that may arise now or during the future of recovery. Attorneys and Partners at Enoch Tarver, PC, Ed Enoch and Ed Tarver will evaluate legal obligations to consumers, clients & employees, share essential […]

Employment Eligibility Verification: What You Need to Know about the I-9

Immigration isn’t just a hot topic in the news—it has real impact on employers. All employers, including small businesses, are required to complete and retain a Form I-9 Employment Eligibility Verification for every person they hire to work inside the U.S. for pay or any other type of compensation. Failure to comply could result in […]

Dealing with Negative Online Reviews of Your Business

You’ve worked hard to build your small business. Nothing is more frustrating than negative online reviews, particularly if you feel they are unjustified or have been posted in bad faith. There are several steps that you can take to prevent your business’s reputation from being damaged by unfavorable reviews. Respond promptly and professionally. More and […]

What You Need to Know about Family and Medical Leave

Federal law has required certain businesses to offer family and medical leave for decades. An increasing number of states have also enacted or considered passing laws requiring businesses to offer family and medical leave. For small businesses, these laws have distinct pros and cons. This article discusses some of the most important factors small business […]

What is the Difference Between an LLC and an LLP?

If you are starting a new business, the type of business entity you decide to establish will have an impact on the extent of personal liability, how the business is taxed, its management, the level of formality required, and many other factors. There are a wide variety of options, which can make this decision quite […]

The Personal Guarantee: 5 Ways Small Business Owners Can Reduce Their Liability

Small businesses make a huge contribution to the U.S. economy. Nevertheless, starting a new business is risky. Lenders view loans to small businesses, particularly start-ups, as among the riskiest they make, particularly when there is little or no credit history or business revenue on which to base their decision. In an effort to lessen their […]

What Counts as “Hours Worked” Under the Fair Labor Standards Act?

If your small business has non-exempt employees covered by the Fair Labor Standards Act (FLSA), you are required to pay those employees in accordance with its minimum wage and overtime requirements for all “hours worked.” This may seem like a simple requirement, but figuring out what is considered “hours worked” may be more complicated than […]